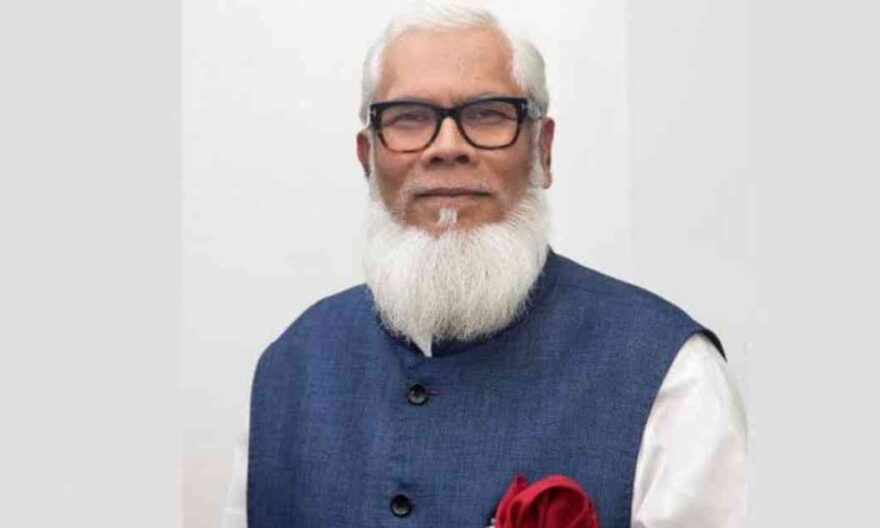

Companies associated with Salman F Rahman, former private sector adviser to former prime minister Sheikh Hasina and vice-chairman of Beximco Group, owe around Tk36,865 crore to seven banks in the country, including four public and three private banks, according to documents obtained by the news media.

The banks involved are Janata Bank, Sonali Bank, Rupali Bank, Agrani Bank, National Bank, IFIC Bank, and AB Bank.

Salman, who was arrested on Tuesday night in the Sadarghat area of the capital during an alleged escape attempt, abused some state-owned banks turning them into weak banks, the documents reveal.

As per the documents, companies reportedly linked to Salman F Rahman owe Tk23,070 crore to Janata Bank, Tk1,838 crore to Sonali Bank, Tk965 crore to Rupali Bank, Tk1,409 crore to Agrani Bank, Tk2,952 crore to National Bank, Tk6,031 crore to IFIC Bank, and Tk605 crore to AB Bank.

However, according to a report by Bangladesh Bank, the loans owed by companies associated with Salman F Rahman to IFIC Bank alone total around Tk11,000 crore.

Most of these loans have been kept unclassified through multiple reschedulings, despite being overdue for classification, according to a senior official of the Bangladesh Bank.

Janata Bank

The state-owned Janata Bank has not provided financing for the past year, as Beximco Group alone utilised the entire lending capacity of the bank by taking loans totaling around Tk23,070 crore as of 14 August, exceeding the single borrower exposure limit.

Beximco Group continued debt servicing with Janata Bank by securing fresh loans through the creation of new companies, which accumulated a massive amount of debt and restricted the bank’s business to a single borrower.

The conglomerate secured loans against at least 28 companies from the bank’s local office branch, according to documents obtained by the news media.

This is how Beximco paralysed the business operation of Janata bank putting it into huge loss exposing depositors’ money worth Tk1.10 lakh crore as of December last year.

Janata bank showed net profit of Tk55 crore at the end of December 2023 taking forbearance for maintaining required provision against default loans. If the bank would maintain provision, it would be in loss of more than Tk1,000 crore, according to the bank sources.

The provision shortfall of the bank was Tk2,700 crore as of December last year, central bank data shows.

Janata bank continued to finance Beximco owned companies even after exceeding single borrower exposure limit through taking special permission from the central bank.

When addressing the annual general meeting for 2023 held in June this year, Janata Bank chairman Prof Dr SM Mahfuzur Rahman said that some banks, including Janata, have lost their capability to disburse fresh loans as laid-out loans are not coming back to the lenders.

Instead of disbursing any fresh loan, they would rather concentrate on recovering defaulted loans, said Dr Rahman.

The Beximco Group also has overdue loans of $56 million as of 14 August from the Export Development Fund (EDF) in foreign currency provided by Janata Bank.

The Bangladesh Bank suspended EDF financing with Janata Bank a year ago due to the overdue loans from Beximco Group.

EDF loans are sourced from the foreign exchange reserve and are offered to exporters at a very low rate of 3% to 4%.

These loans are intended to facilitate exports, but the overdue EDF loans indicate that Beximco used reserve currency at a low rate without repatriating the export proceeds, leading to overdue payments.

Additionally, Janata Bank has been blacklisted by many foreign lenders due to non-payment issues related to imports by the Beximco Group.

The News Media has obtained numerous complaints filed with the Indian Commission in Dhaka by Indian exporters against Beximco Group for non-payment.

Despite these issues, Janata Bank did not take any action against Beximco Group and continued to provide financing until Salman F Rahman was arrested following the downfall of the Hasina government.

IFIC Bank

A senior official from the central bank told the news media that about ten of IFIC Bank’s top 30 largest borrowing companies are owned by Salman F Rahman, who is also the bank’s chairman.

Among IFIC Bank’s top borrowers are Sreepur Township, which has loans amounting to Tk1,020 crore, Sunstar Business with Tk615 crore, Fareast Business with Tk614 crore, Cosmos Commodities Limited with Tk612 crore, Uttara Jute Fibers with Tk552 crore, Absolute

Construction & Engineering Ltd with Tk463 crore, Apollo Trade International Ltd with Tk455 crore, Altron Trading Ltd with Tk449 crore, and Northstone Construction & Engineering Ltd with Tk421 crore.

All these companies are associated with Salman F Rahman, according to a Bangladesh Bank official who spoke on condition of anonymity.

Additionally, Tk426 crore was borrowed under the name of Assad Trading & Engineering Ltd, and over Tk400 crore was borrowed by Serve Construction from IFIC Bank, both of which are also linked to Salman.

A member of the central bank’s inspection team told the news media that, despite the different names of managing directors and chairpersons, the loans were actually taken out by Salman F Rahman. The eleven institutions mentioned collectively owe Tk6,000 crore.

A central bank director noted that IFIC Bank also holds several smaller loans linked to Salman F Rahman. These companies have secured approximately Tk150 crore to Tk200 crore in loans from the bank within 6 months to a year of their establishment.

He said, “These companies are located in Dhanmondi, Gulshan, Badda, and Rampura areas. But on the ground, these companies are not functioning properly.”

According to a report from Bangladesh Bank, IFIC Bank’s total loans at the end of December 2023 amounted to Tk41,248 crore. Of this, Tk2,589 crore, or 6.28%, were classified as defaulted loans.

A detailed inspection by the central bank revealed that IFIC Bank’s total non-performing loans were approximately Tk8,000 crore, or 24%.

The inspection also found that around Tk11,000 crore of the bank’s loans were associated with Salman F Rahman.

National Bank

Bloom Success International Limited, a company associated with Salman F Rahman, has loans amounting to Tk836 crore from National Bank. Moreover, Salman’s Beximco Group owes Tk823 crore, and Beximco LPG Unit 1-2 has Tk1,293 crore in loans from National Bank.

Agrani Bank

Beximco Ltd holds loans of Tk663 crore, Beximco Pharmaceuticals Ltd owes Tk375 crore, and Beximco Communication Ltd has Tk371 crore in loans from Agrani Bank.

AB Bank

Beximco Group has loans amounting to Tk600 crore taken from AB Bank.

How IFIC bank was abused

Salman F Rahman has held the chairmanship of IFIC Bank for 14 years since 2010, despite owning only 2% of the shares. His son serves as vice chairman with a 2% stake, while the government owns 32.75% of the shares and the general public holds 61%.

Under his chairmanship, he allegedly abused the bank’s resources through financial engineering.

For example, last year IFIC Bank issued “IFIC Aamar Bond” worth Tk1,000 crore for Sreepur Township Ltd (STL), a newly-formed real estate company in partnership with Beximco Group.

IFIC Bank guaranteed the Aamar Bond, meaning the full liability of Tk1,000 crore fell on the bank, which eventually eroded its capital and put depositors’ funds at risk.

The Bangladesh Securities and Exchange Commission (BSEC) approved this large bond issue for a new project without evaluating the financial capacity for interest payments.

If the STL project fails, IFIC Bank will be responsible for repaying the investors, despite having no direct involvement with the project.

The guarantee also presents a conflict of interest, as Salman F Rahman has stakes in both IFIC Bank and STL.

When the bank was raising funds for the chairman’s personal business and spending public money to promote bonds for STL, this was completely overlooked by the central bank.

IFIC Bank provided a guarantee for a high-interest-bearing bond at 12%, even though STL was established only in March that year and lacked experience in constructing flats or developing plots, let alone building a township.

Despite this apparent corruption, no regulator has dared to raise questions. Later, in March of this year, just before his term ended, BSEC Chairman Shibli Rubayat Ul Islam allowed Beximco to raise Tk2,600 crore through issuing bonds to invest in STL.

As a result, Salman was able to raise a total of Tk3,600 crore for his new real estate company, putting investors at risk of not receiving their returns.